top of page

JODIE BARR | PRODUCT DESIGNER

Mortgage Match Quiz

FREEDOM MORTGAGE

Helping potential homeowners understand what loans may work for different scenarios

MY ROLE

UX/UI Design | Research |Usability Testing

TOOLS

UserTesting.com | Sketch | Invision

Buying a home can be a difficult process. There is so much to be done and there is a lot of information to absorb. The average person is not aware of the loan types that exist and their requirements. This is just the beginning of what is usually a very stressful experience.

CHALLENGE

Finding a loan type that best fits your situation and that you qualify for is one of the first steps in a home buying process. How might we match users interested in the home buying process to a loan type that best fits their needs?

RESEARCH

To begin I did moderated testing to better understand the problem and the user.

I wanted to do the folowing:

• Gauge desirability for quiz

• Discover what users wanted from this experience

• Uncover end journey expectations

I started by giving users a list of 10 loan match tools. I asked them to rank them in order from preferred to least preferred. From the list given I recorded the top 3 favored tools.

Top 3 loan match tools

1. A quiz that will match you to a loan

2. A quiz that will match you to a specific loan/refinance product

3. A list of loan/refinance products with filter capability

The loan match quiz option outweighed the other 10 options. In another round of research I asked a different set of users "would they be interested in a loan match quiz" and "if they had ever taken a loan match quiz before

100% of users would be interested in taking a loan match quiz

100% of users had never taken a loan match quiz before

Would you be interested in a loan match quiz?

"Definitely...if my mortgage lender offered it i'm always down to take a quiz to see if it gives me different options or teaches me something new..."

- glevotr (50, female)

Our team has a progressive form design that exists within our Design System that could be used as a starting point. This experience needed to be re-purposed and tailored to fit the new user type that I will uncover. In order to do this I would have to test the design in its current state and use the feedback for the newer version.

USER FEEDBACK

There is a "hold my hand" user type that exists. This user type appreciates learning things that are relevant to the mortgage loan process. They loved the quiz but would love to increase the educational value of the quiz by doing the following:

• Provide information about the effect certain factors have on loan eligibility

• Add a way for users to re-calculate their outcome depending on changing circumstances

• Explanation for disqualified loan options

• Ranking of loan offerings (if applicable)

END JOURNEY EXPECTATIONS

At this point I know what is expected from the quiz, but how about afterwards? I tackled this by showing participants a list of possible outcomes to be shown after a loan match has been made. I was able to narrow the outcomes down using the top 3 preferred pages.

Product Suite Page (PSP)

PDP Page - Includes information about all products in a loan suite.

(ex. FHA Suite would include - FHA purchase, FHA refinance, and FHA cash out refinance.

Product Details Page (PDP)

PSP Page - Includes information about specific loan product. Also includes bulleted info about other loan types.

Ex. FHA page would primarily show details for FHA purchase.

Product Comparison Table

Comparison Table - Includes all loan and product types with filter to narrow down available options.

In another round of testing I asked participants to choose 1 of the 3 remaining pages and to explain the reason for their choice.

Which page met your expectations?

Product Suite Page (PSP)

• Page was useful but didn't meet majority expectation

• Too detailed and slightly overwhelming for an

uninformed user

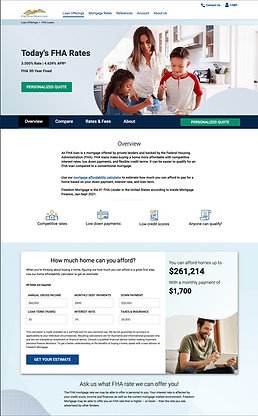

Product Details Page (PDP)

• Aligned with expectations of the majority

• Easier to understand

• Includes information about other loan types as well

(easy to compare)

•

Comparison Table

• Useful but not aligned with the needs of user type we are serving

• Page is more aligned with expectations of repeat buyers or consumers with more knowledge

about mortgage loans.

Product Details Page (PSP)

- Highest rating for alignment 4.4/5

- Page felt less overwhelming and information is easier to process for an uninformed user.

- Page has card tiles with information about the 4 loan types offered at Freedom Mortgage which makes it easy to do a low level comparison.

- Page also has a "Get a quote" CTA which is attractive for some participants.

ADDITIONAL SOLUTIONS

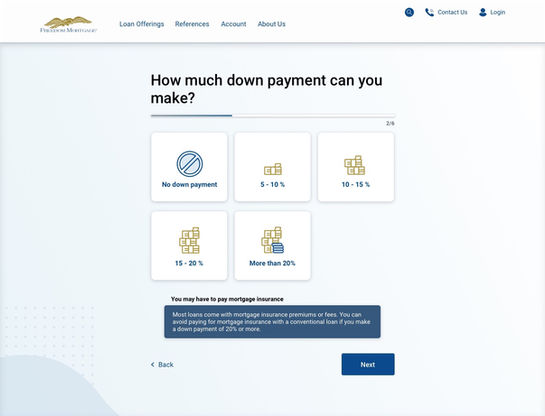

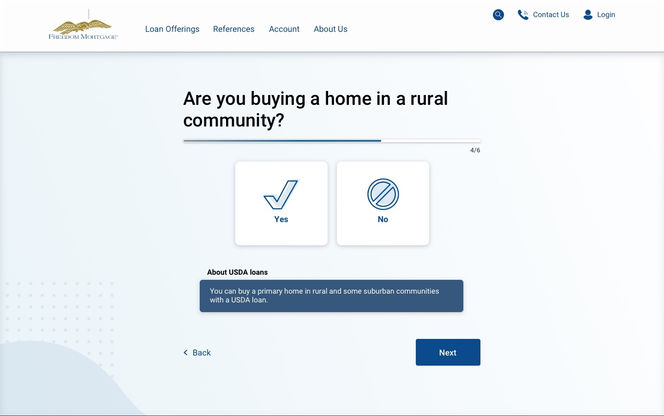

Added features include an informational toast element that appears after a user selects an option. This toast includes information related to the current question or selections. Participants found these extremely helpful. Content for these toasts came directly from questions and inquiries heard throughout testing. The most common questions are answered as they progress through the quiz. This increases the educational value of this product. The learning starts while the quiz is in progress versus only at the end when the user has been matched to a product.

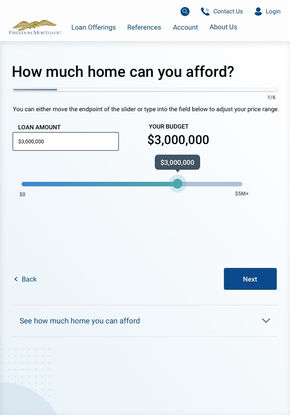

Adding a home affordability calculator for the "How much home can you afford" screen helps users to gain a better understanding of their situation without having to leave the quiz.

And last but not least the "retake quiz" button allows the person taking the quiz to change their answers as many time as they'd like if they desire to see what loan types they may be eligible for under different circumstance.

FINAL PRODUCT

Below are some of the high concept screens from desktop, tablet and mobile for the Mortgage Match Quiz. This quiz is currently in development.

bottom of page